what is stamp duty

Calculate the stamp duty you may have to pay on your property using our tool. If the purchase is not made by an individual eg.

Stamp Duty London New Thresholds Barratt London

Separate land taxes apply in Scotland and Wales.

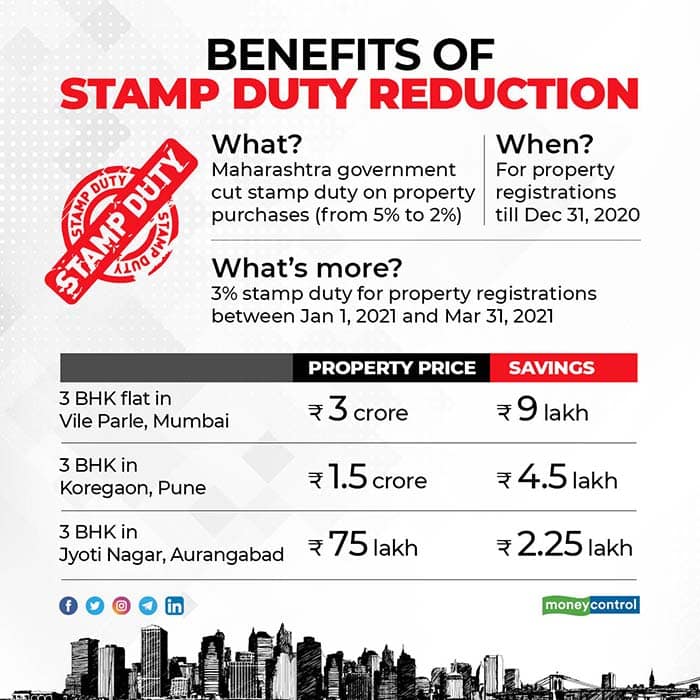

. Stamp Duty Land Tax relief for land or property transactions. If the property consideration value is rs 75 lakh the stamp duty calculation will be as follows-Stamp Duty is 7 percent of Rs 75 lakh Rs 525000 Registration Charges are calculated at 4 percent Rs 300000. You may be able to claim an exemption or relief.

Therefore the total stamp duty and registration charges will be Rs 825000. Your Solicitor or Conveyancer will be able to provide you with final costing on your new purchase. The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status.

All dutiable transactions of property or land including gifts attract stamp duty in Queensland. We recommend that you do obtain the appropriate Legal Advice. However the heading Other Stamp Duty covers electronic share trading CREST Stamp Duty on financial cards and Stamp Duty levies.

Stamp Duty refunds can only be issued by electronic transfer while the coronavirus measures are in place. The amount you pay is based on Stamp Duty bands. Calculate Stamp Duty on Non-Commercial Vehicle.

How we connect with you. So what properties are excluded from buy-to-let stamp duty. The dutiable value of the property generally the purchase price or market value at time of contract whichever is greater.

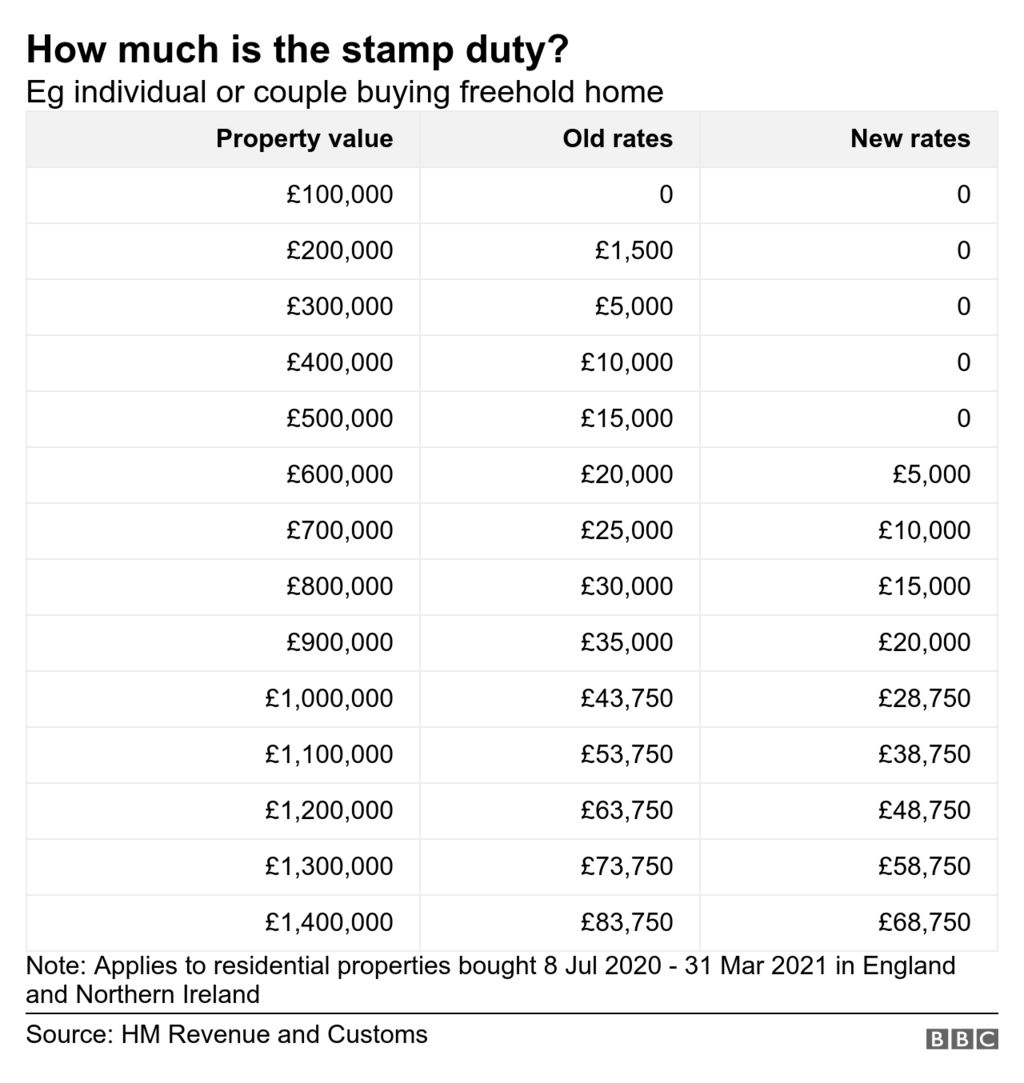

These calculators are designed to give you an indication of stamp duty payable on the conveyance of real estate and business property and the issue and transfer of motor vehicle certificate of registration. You must pay Stamp Duty Land Tax SDLT if you buy a property or land over a certain price in England and Northern IrelandThe tax is different if the property or land is in. This revenue is added into all state government budgets which typically cover sectors such as health transport and roads police justice and emergency services says Walker.

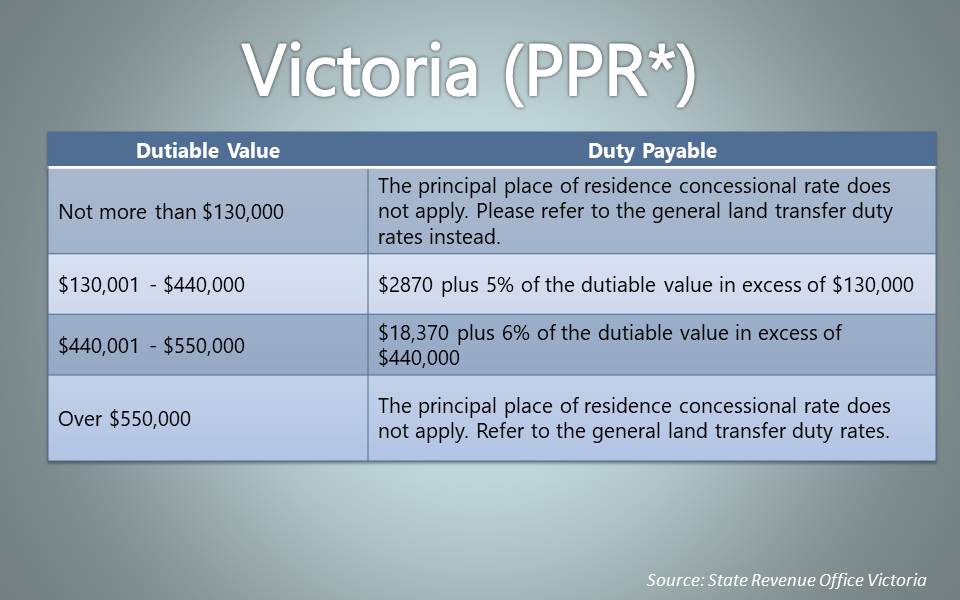

Unless an exemptions or concession applies the transaction is charged with duty based on the greater of the market value of the property or the consideration price paid - including any GST. The residential rate of duty only applies to transactions entered into before 1 July 2022. In UK stamp duty is known as SDLT or stamp duty land tax.

Application for Refund of Buyers Stamp Duty Partial Refund of Ad Valorem Stamp Duty for properties acquired for Redevelopment under section 29DD 29DE of the Stamp Duty Ordinance Cap. We would like to show you a description here but the site wont allow us. Stamp duty is paid by buyers of land or property in England and Northern Ireland with higher rates above certain thresholds.

Stamp Duty Land Tax. Stamp Duty Land Tax on Leasehold sales. Stamp duty is invested into the economy by the state and territory governments which collect it.

If the property is situated outside Ireland there may still be a charge to Stamp Duty. The NSW government will need to overcome opposition from Labor and some upper house MPs to get its new land tax legislation through both houses of. Help for people affected by natural disasters.

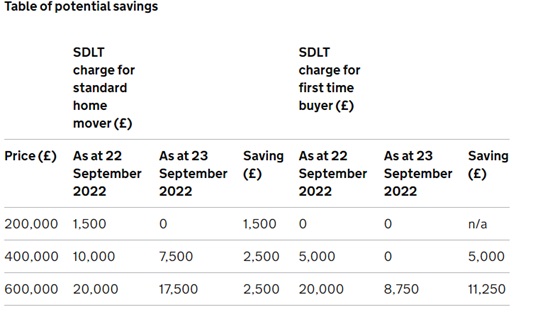

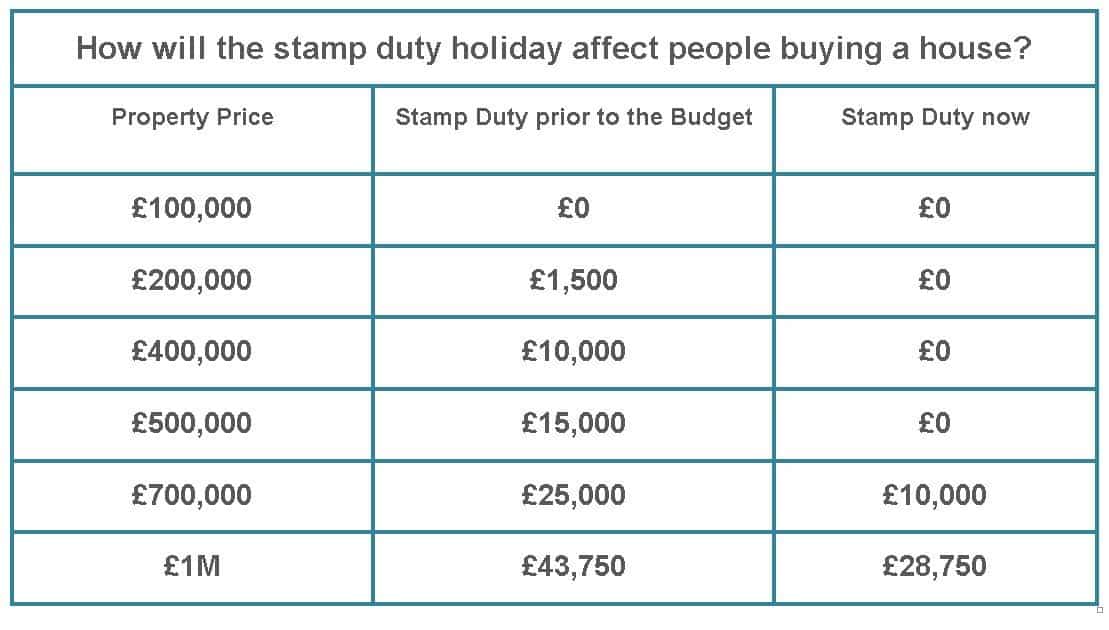

Stamp duty rates table. If you are in England or Northern Ireland it will be called Stamp Duty. Linked purchases or transfers.

Residential stamp duty rate including purchases of less than 10 houses or duplexes in a year. Where the stamp duty calculated includes a. If you are in Scotland it will be Land and Buildings Transaction Tax LBTT and in Wales it will be Land Transaction Tax LTT.

Transfer duty self assessor guidelines. The residential rate of duty applies to certain dutiable transactions over residential land. Stamp Duty is calculated based on the value of the property youre buying.

The rates of duty used are effective 1 July 2008. The buyer is a company rather than a person the additional stamp duty will apply regardless of how many properties the company owns. Unpaid tax interest and penalties.

They are provided for information purposes only and should not be substituted for formal professional advice. This calculator calculates duty for dutiable transactions. Transferring property can involve issues for other taxes particularly Local Property Tax Capital Gains Tax and Capital Acquisitions Tax.

Refer to the Section 67 Document Guide PDF 120KB or contact RevenueSA for advice on this. However there is an increased stamp duty rate of 10 if you buy 10 or more residential houses or duplexes at a time or cumulatively in a year see tables below. Our Stamp Duty calculator lets you know the amount of tax youll be liable to pay.

Objections reviews and appeals. In general the stamp duty rate is based on property value. Use this calculator to determine stamp duty payable on commercial vehicles such as utilities vans panel vans and heavy Vehicles.

Stamp duty is a tax on a property transaction that is charged by each state and territory the amounts can and do vary. 117 For Applicant who is an Individual--- 7. If two or more documents arise from a single contract of sale or together form or arise from substantially one transaction or one series of transactions Section 67 of the Stamp Duties Act 1923 may result in duty being assessed on the total transaction considerationvalue.

This calculator works out the land transfer duty previously stamp duty that applies when you buy a Victorian property based on. Itll work out how much Stamp Duty youll owe whether youre a first-time buyer moving home or buying an additional property. Stamp Duty is a tax paid to government when buying a new home.

The tax is calculated on the part of the property price falling in each band. For more information see When is an instrument liable to Stamp Duty. Stamp Duty Land Tax.

Stamp duty reform should be allowed to go ahead. Information added on the process for providing your bank account details. With effect from 1 April 2010 stamp duty on sale of immovable property in Hong Kong is charged at rates which vary with the amount or value of the consideration as follows.

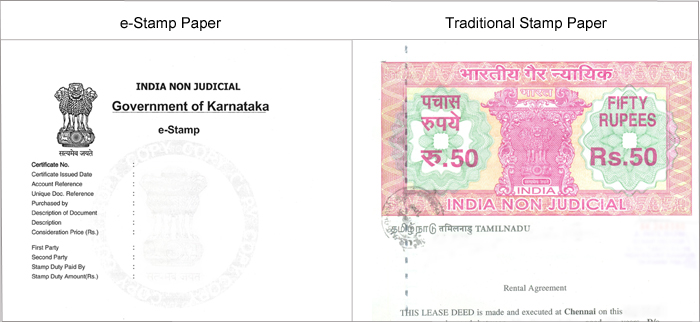

Scotland - pay Land. The date of the contract for your property purchase or if there is no contract the date it is transferred. Stamp Duty This section deals with Stamp Duty on instruments written documents.

If the total price paid for the property is up to 40000 you wont need to pay any stamp duty at all. Use this calculator to determine stamp duty payable on non-commercial vehicles such as sedans wagons hatchbacks coupes and four-wheel drives. - The Stamp Duty Calculator provides you with an indication of costs.

Further information about Duties is available.

Stamp Duty Changes All You Need To Know 2021 Allison Homes

All You Wanted To Know About Stamp Duty Youtube

Stamp Duty And Registration Charges In Pune Rates How To Calculate

What Is Stamp Duty And Registration Charges In Maharashtra

Uk Housing Stocks Rise On Potential Cut In Stamp Duty Reuters

Legaldesk Com What Is Stamp Duty

New Stamp Duty Charges For Residential Property Purchases North Ainley Solicitors

Maharashtra Lowers Stamp Duty How Much Will Home Buyers Gain

Return Of Stamp Duty Tax For E Instruments Mpg

What Is Stamp Duty And Registration Charge In Delhi

Determining Factors For Stamp Duty Over Property Hdfc Sales Blog

Stamp Duty Rate Outlet 56 Off Ilikepinga Com

What Is Stamp Duty Do I Need To Pay Stamp Duty Wain Homes

Stamp Duty 101 Land Transfer Duty In Australia Your Mortgage

Property Buyers Vital Things You Should Note About Stamp Duty For A Smooth Settlement Kdd Settlement Agent Perth

What The Stamp Duty Land Tax Holiday Extension Means

What Is Stamp Duty Now Gatehouse Estates

Do New Stamp Duty Taxes Mean Bye Bye Buy To Let Buying To Let The Guardian

0 Response to "what is stamp duty"

Post a Comment